Everything You Need to Know for the Fed Meeting This Week

by Aki Ito

September 16, 2015 — 6:00 AM CST

The Federal Reserve will meet for two days starting Wednesday and it’s the most highly-anticipated gathering in years. On the agenda: A potential interest-rate increase, which would mark an end to almost seven years of holding borrowing costs near zero.

Here are the stories we’ve written in the lead-up to the decision, scheduled for release at 2 p.m. Thursday in Washington. We’ll keep updating this post as more stories come in.

- The Fed should wait to raise interest rates well into 2016, said Andrew Levin, who served as a special adviser to former Fed Chairman Ben S. Bernanke and then-Vice Chair Janet Yellen from 2010 to 2012.

- The U.S. is probably about two years away from achieving full employment, no matter what the jobless rate suggests, Levin said.

- The chart below, using calculations from Levin, puts the amount of slack still in the labor market at 2.2 percent of the potential labor force.

- There’s a more palatable option for those investors too wimpy to stomach the quarter-point increase in interest rates from the Federal Reserve.

- A 12.5 basis-point rise would “certainly be unusual, and surprising, but then after the last eight years or so of unconventional monetary policy, unusual is becoming the norm,” ING Bank NV economists said in a report to clients on Tuesday. UniCredit SpA and VTB Capital Plc have also joined this call.

- The Fed will probably stay put this time, according to Tim Duy, a professor at the University of Oregon.

- As of Sept. 15, just over half of economists surveyed by Bloomberg News—57 out of 111—agree with Duy. Fifty-four expect a rate increase, four of whom are expecting the 12.5 basis-point mini-hike.

- The wavering global economy makes a rate hike right now too risky, Duy wrote.

- But the committee will indicate that it’s still committed to raising interest rates this year, he said.

- The Fed’s actions on Thursday will reverberate far beyond Wall Street.

- The president and chief executive officer of Pendleton Community Bank says that demand for loans is rising, with customers “feeling better about where they are.”

- If the Fed doesn’t raise rates this week, the West Virginia country banker may have to do it himself.

- “Don’t overestimate the benefits of waiting for the situation to clarify,” Fischer said in a speech just three months before taking over as the Fed’s No. 2 official in June 2014.

- More recently, Fischer was asked in a CNBC interview if the Fed should delay an increase until it had an “unimpeachable case” that a move was warranted. His response: “If you wait that long, you will be waiting too long.”

- The Fed faces a very tough call, partly because there are big risks whether the central bank stays or goes.

- Raise now and the world economy could buckle. Don’t raise now and the bank might have to hike rates more quickly later on than it was hoping to.

- You wouldn’t want to be in Chair Yellen’s shoes right now.

- The economy right now looks great, with auto sales booming and a very low unemployment rate, but the future is much murkier.

- The Fed’s big decision comes down to whether officials focus more on the now or the outlook.

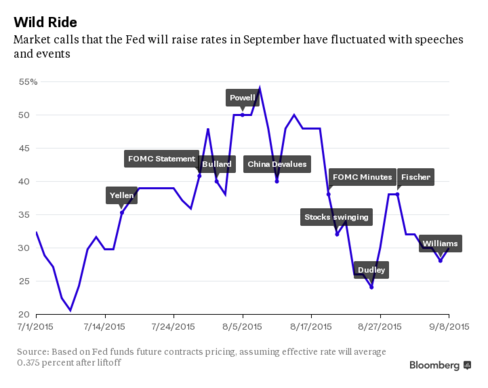

- If you weren’t paying attention, here’s what policy makers have said since mid-July.

- The chart below juxtaposes those comments against the odds that investors have attached to a September rate increase.

- http://www.bloomberg.com/news/articles/2015-09-16/everything-you-need-to-know-for-the-fed-meeting-this-week