The S&P May Do Something It’s Only Done During Financial Crises

November 2, 2016 Julie Verhage

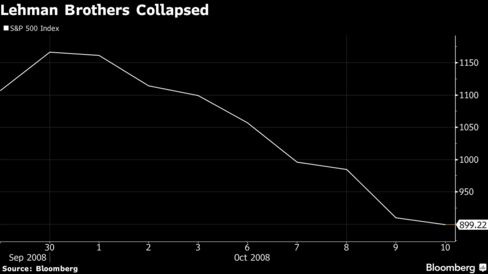

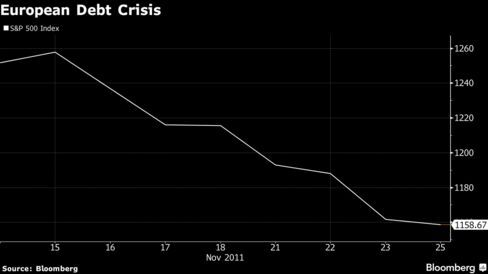

Over the last 20 years the S&P 500 index has only recorded a seven-day losing streak on three separate occasions. The first was in 2008 after Lehman Brothers collapsed, while the other two were during Europe’s 2011 debt crisis. If the index ends the day lower on Wednesday, it’ll chalk up a fourth.

While this run of losses has longevity, it doesn’t have depth. Tabb Group LLC Analyst Callie Bost pointed out that the previous instances all involved at least one day where the S&P 500 fell by more than one percent, which isn’t the case with the present slide. As of 11:01 a.m. in New York, the index’s losses since its last day of gains stood at 2.2 percent.

The index’s longest-ever run of losses was eight days, matched at the height of the financial crisis in October 2008. The S&P 500 started falling on Monday September 29 and saw lower closes at the end of every trading day until October 10, in what was its worst week in history.

The next was a seven-day losing streak that went from July 25 2011 through to August 2, at the height of the European debt crisis and just before S&P downgraded its rating on U.S. sovereign debt.

The index next seven-day run of losses owed to spillover from the crisis in Europe, as the cost of insuring European government debt surged to a record. Stocks began their slide on November 16 2011 and didn’t move higher until November 28.

The latest tumble has been blamed on uncertainty surrounding the presidential election in the U.S. that is less than a week away.